Updated: May 2, 2025 (May 2, 2025)

BlogMicrosoft Q3 FY25 earnings: What Enterprises Need to Know

Microsoft reported its Q3 FY25 earnings this week. Coming in at $70.1 billion USD in revenue for the quarter and earnings of $3.46 USD/share, the results exceeded expectations. Unsurprisingly, Microsoft execs gave most of the credit to the Microsoft Cloud and Azure, in particular.

Microsoft Cloud – the Microsoft-defined bucket of commercial cloud properties including Azure, M365 commercial, Dynamics 365, etc. — delivered $42.4 billion USD in revenue, up 20% from the year-ago quarter. Azure and other cloud services revenue were up 33%, with 16 points of that coming from AI, they said. (Microsoft still doesn’t disclose Azure revenues in dollars.) And for Q4 FY25, Microsoft is projecting Azure and other services growth will be between 34% and 35%.

Microsoft is still on track to spend $80 billion USD on building the datacenter/AI infrastructure during its fiscal 2025, which ends June 30. Microsoft opened datacenters in 10 countries across 4 continents this quarter alone. Last quarter, Microsoft officials had said they expected to be able to ease back on this spending starting in July, but because datacenter capacity demand is growing faster than it expected, “we now expect to have some AI capacity constraints beyond June,” CEO Satya Nadella said.

Microsoft 365 Commercial Now at 430 Million Paid Seats

In Jan. 2024, during its Q2 FY24 earnings call, Microsoft officials said the company had 400 million paid Microsoft 365/Office 365 seats. That figure is now 430 million paid commercial seats, up 7% year over year, as of this quarter, officials said. The growth is largely due to small/mid-size businesses and frontline workers. M365 consumer subscriptions are now at 87.7 million, in spite of Microsoft’s recent price increase.

Microsoft still is not providing publicly a Microsoft 365 Copilot adoption number. Officials said Microsoft 365 Copilot is being used by “hundreds of thousands of customers” and is up three times year-over-year. (It’s not clear whether this count includes the “free” Microsoft 365 Copilot Chat, but as officials didn’t mention these are “paid” seats, I’m guessing Microsoft 365 Copilot Chat is part of these totals.)

- A few other enterprise-focused datapoints Microsoft officials shared in the earnings call:

- There are 21,000-plus paid Fabric customers now, up 80% year over year. Real-time intelligence is the fastest growing workload in Fabric.

- The Microsoft Phi small language model has been downloaded 38 million times.

- There are now more than 15 million GitHub Copilot users, up more than four times year-over-year.

- There are now 56 million monthly active Power Platform users, up 27% year over year.

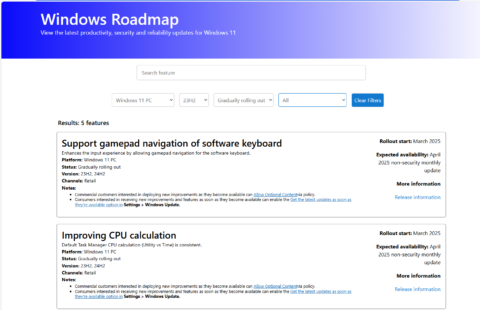

- Windows 11 commercial deployments are up 11% year over year. (Note: Most PC-tracking firms say Windows 11 is still on fewer than 50% of work and personal-use PCs.)

- Windows OEM and Devices revenue was up 3% year over year, which is ahead of expectations as tariffs imposed by the U.S. government led to uncertainty through the quarter.

Datacenter Slow-Down: Nothing to See Here, Microsoft Says

As expected, almost all of the Wall Street analyst questions at the end of the April 30 earnings call were focused on reports that Microsoft recently has been pulling back on planned AI/datacenter spending. Chief Financial Officer Amy Hood and Nadella claimed these reports are the result of analysts paying more attention than before to Microsoft’s CapEx spending patterns. (Hmm…) They maintained that Microsoft is making normal adjustments to datacenter build-out plans that were originally created years ago, based on current demand signals.

Hood emphasized that Microsoft’s CapEx plans are not entirely about AI. She told analysts that non-AI spending was higher than expected in Q3.

“The real outperformance in Azure this quarter was in our non-AI business. The only real upside we saw on the AI side of the business was that we were able to deliver supply early to a number of customers,” Hood said.

Watch for Microsoft’s Coming Sales Reorg

Separate from earnings, Microsoft announced internally a sweeping sales reorg late last week that will take effect July 1. The company looks to be trying to flatten the sales org and is moving a lot of the vertical businesses around into new operating units.

Microsoft’s current sales org is designed around six solutions areas: Modern work, Business Applications, Digital & App Innovation, Data & AI, Azure Infrastructure, and Security. The plan is to combine these into three areas: AI Business Solutions, Cloud & AI Platforms, and Security.

Microsoft is making a big push to build up technical expertise in the field and is requiring sales to meet certain AI skilling criteria over the next couple of months as part of its effort to “accelerate AI transformation.”