August 1, 2025

BlogWhat Microsoft’s Blowout Q4 Could Mean to Enterprise Customers

Microsoft beat its own and Wall Street’s expectations with its Q4 FY25 earnings, and the company’s stock price and market cap hit all-time highs this past week. Nice if you’re a shareholder or employee who survived the latest rounds of layoffs. But if you’re a Microsoft enterprise customer, what’s your takeaway from all this?

There are some clues in the numbers that Microsoft did — and didn’t — disclose in its Q4 report.

Azure, By the Numbers

For the first time ever, Microsoft provided an actual Azure revenue number as part of its Q4 report. For years, the company has declined to do so, speaking only in growth percentages without disclosing revenues, seemingly to prevent itself from being compared to AWS and Google Cloud.

Microsoft’s overall revenues for FY25 were $282 billion. Azure revenues were slightly less than half of the $168 billion in “Microsoft Cloud” revenue the company measured for fiscal 2025. (“Microsoft Cloud” is Microsoft’s own metric consisting of cloud revenues from Azure, Microsoft 365, Dynamics 365, some components of GitHub and LinkedIn and more.)

For its fiscal 2025, ending June 30, 2025, Azure and “other cloud services” surpassed $75 billion in revenue, up 34 percent year-over-year, Microsoft said, and it’s estimated to grow another 37% in Q1 FY26. Comparatively, AWS is at an annual revenue run rate of more than $123 billion, and Google Cloud at more than $50 billion.

Oddly, Microsoft’s latest earnings report didn’t disclose how much of its Azure revenue was attributable to AI. During the past several quarters, Microsoft provided either a number of points or a percentage of Azure revenues that came from AI workloads. Officials didn’t say why they decided against providing that figure this time around.

Microsoft execs instead emphasized that Azure revenues in FY25 were attributable across “all workloads.” They said Microsoft now has more than 400 datacenters across 70 regions, and that cloud demand remains higher than supply. In Q4 alone, Microsoft’s capital expenditures were $24.2 billion, with most of that going toward datacenter leases, servers, GPUs and other infrastructural components. Microsoft plans to continue to grow capex, predicting Q1 FY26 capex spending would hit $30 billion.

Microsoft 365: Numbers Shared and Not

Meanwhile, Microsoft 365 commercial had a strong Q4 as well, with revenues up 16%. Microsoft officials attributed seat growth primarily to new small-and-midsize businesses (SMBs) and frontline workers. They attributed growth in revenue per user to high-end E5 subscriptions, as well as Microsoft 365 Copilot.

Microsoft has not released an updated number as to what percentage of the Microsoft 365 commercial base is on E5 in years. In 2022, that number was just 12%. Each year since then, Microsoft sales has made migrating and upselling customers to E5 a priority.

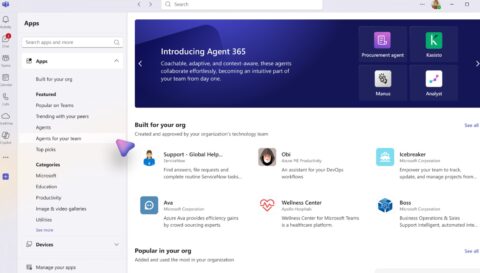

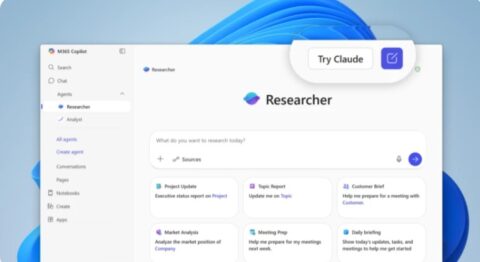

Microsoft also has yet to release a number as to how many Microsoft 365 Copilot subscriptions it has sold. Instead, like it used to do with Azure before this quarter, Microsoft execs continue to provide difficult to quantify numbers about Copilot sales and adoption.

For example, officials said the company now has 100 million monthly active users “across our family of Copilots” in both the commercial and consumer space, but it’s not clear if this figure includes M365 Copilot Chat, which is free for business customers with M365 subscriptions. Microsoft also said GitHub Copilot now has 20 million users and the Dragon Copilot had 13 million “physician-patient encounters.” They added that Microsoft 365 Copilot saw “the largest quarter of seat adds since launch,” in Q4 FY25, and a record number of customers returning to buy more seats. But there was no actual Microsoft 365 Copilot number or any talk of revenues coming from M365 Copilot during the earnings call.

Reading the Earnings Tea Leaves

There are some takeaways from these numbers (and non-numbers) that are likely to affect enterprise customers in the coming year.

First, Microsoft’s pressure to adopt its various Copilots won’t be letting up. It’s a safe bet to assume adding more commercial Copilot seats and licenses will be a key part of any Microsoft licensing negotiation.

Ditto with the priciest Microsoft 365 tier. Microsoft and partners will continue their mission of getting even more customers to go with E5. Those who already are there should expect Microsoft to be pushing paid add-ons to their E5 subscriptions for things like Teams Premium, SharePoint Advanced Management (for the entire company, not just M365 Copilot users), etc.

Company officials noted on the earnings call that Microsoft Purview data governance and security tools are already used by three quarters of Microsoft 365 Copilot customers, but there’s still room for more add-ons there, too.

“Customer adoption of Copilot and AI is Microsoft’s biggest priority,” said Directions analyst Jim Gaynor. “And there will be the need for even more add-ons, as organizations realize they need things like Purview, SAM, and Azure AI Content Safety to complete the picture. Microsoft’s relying on that to keep increasing their revenue.”