Why Dynamics 365 is the Lalapalooza of Microsoft licensing complexity.

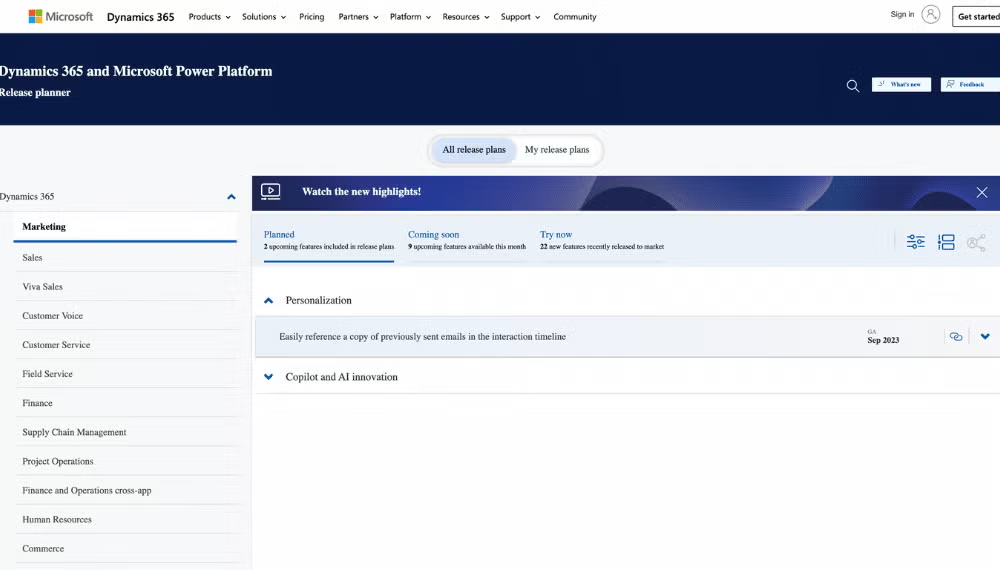

What’s included in Microsoft Business Services

Dynamics Applications

Microsoft business services include Dynamics 365–branded horizontal applications for:

- CRM

- Marketing

- Sales,

- Commerce,

- Supply chain,

- Finance/accounting, and

- Human resources.

Dynamics 365 is often extended programmatically by tailoring the system to capture and process additional types of data and by creating task-specific custom applications.

Power BI Components and Fabric Tools

Business services also encompass Power BI–branded data modeling and reporting components and Fabric, Microsoft’s new data-analytics platform. Fabric includes branded data lake storage and data-analytics tools, which incorporate features for machine learning, data cleansing, real-time data processing, and data integration pipelines.

Business Services & Tools Licensing and Purchasing Basics

Dynamics 365

Dynamics 365 consists of many traditional business applications, each sold à la carte because there are no longer Dynamics 365 suites. The applications are licensed via several tiers of Per-User and Per-Device subscriptions that vary by feature set.

There are also numerous Dynamics 365 add-ons (licensed Per-User and by capacity) providing supplemental business features, extra storage, and development/test environments isolated from production. For certain task-specific custom applications, customers may save money by using Power Apps Per-User subscriptions as an alternative licensing approach. However, this path has strict limits on the type of data that may be updated and the components developers can use in their apps.

Power BI

Power BI components are licensed Per-User or by a combination of Per-User and back-end platform computational capacity. A back-end platform acts as a repository for data and reports, provides security controls and an end-user portal, and performs a variety of other data management and scheduling tasks. There are six back-end platforms in the Power BI family, each tailored for a different scenario, and they vary by performance, security, and data management features. However, in early 2024 Microsoft announced that Power BI’s capacity-licensing options, representing four of the back-end platforms, are being retired in favor of new Fabric licensing.

Fabric

Fabric consists of several data-analytics tools and data storage. The tools are licensed via a single back-end computational capacity, which is available in several performance tiers and supports hosting. Data storage, referred to as OneLake, is charged on a consumption basis for the actual amount of storage used.

Challenges Specific to Business Services and Tools

Dynamics 365 is challenging to license, especially when it comes to understanding what to buy, staying in compliance, and tracking changes to licensing rules.

3 Dynamics 365 Challenges

Understanding what to buy: Customers must select from a huge number of Dynamics 365 license types (more than most other Microsoft product families) and contend with a complex web of technical and licensing interdependencies. They must also budget for potential capacity-based charges, such as storage, that are difficult to estimate ahead of time.

Staying compliant: Maintaining Dynamics 365 license compliance is often an ongoing struggle, especially as customer deployments change to meet evolving business requirements. For example, sending Dynamics 365 data to another ERP solution, like SAP, means all SAP users who see data originating from Dynamics 365 require Dynamics 365 licenses. Further complicating matters, Dynamics 365 generally lacks robust built-in controls that enforce license compliance.

Tracking changes: Complexity and constant change are the watchwords when it comes to Dynamics 365 licensing. The product lineup has changed frequently, resulting in a huge number of license types and technical and licensing interdependencies.

Power BI and Fabric Advantages

Power BI and Fabric licensing, by contrast, is good news.

If the organization has a deep understanding of its technical needs and the features of each back-end platform, choosing what to license and how much it costs (at least initially) are relatively straightforward.

Additionally, customers have the flexibility to change platforms and license types over time as their usage and other requirements change, without substantial technical or administrative effort. Customers who perform a regular assessment can detect and correct overbuying and adjust accordingly.

Furthermore, regardless of platform selected, Power BI and Fabric license compliance is, for the most part, built in, and situations in which customers are out of compliance are relatively easy to resolve.

Upcoming Microsoft Licensing & EA Negotiation Boot Camp Sessions

This intensive, 18+ hour course provides the most complete, up-to-date Microsoft licensing training available. Get the knowledge and understanding you need to optimize your Microsoft agreements.

Welcome to the world of Microsoft license cost containment whack-a-mole.

Microsoft’s Building Blocks

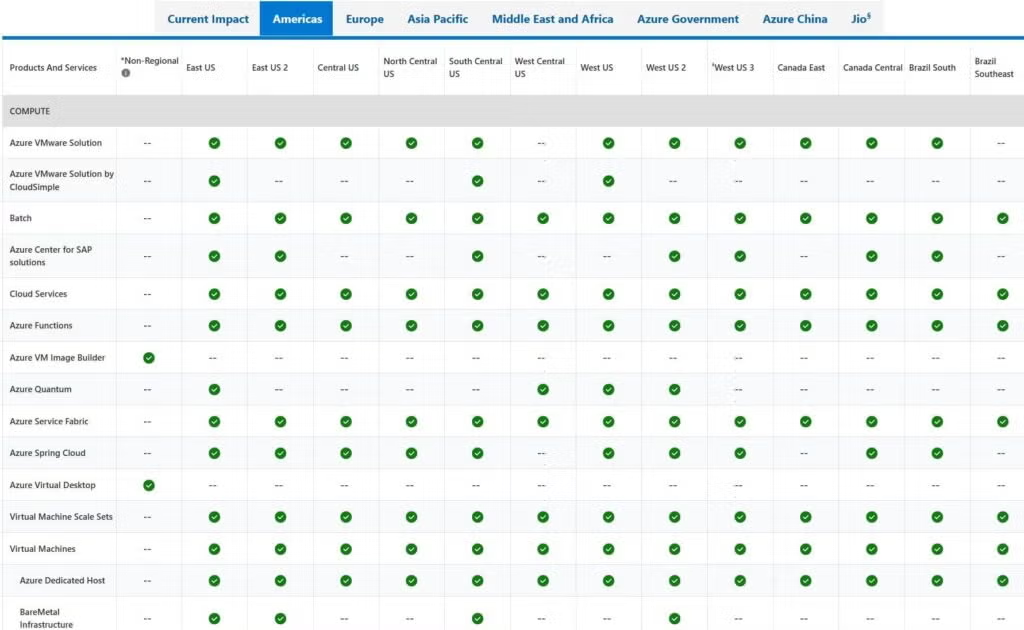

Unlike Microsoft 365 or Power BI, which are finished solutions, Azure developer and IT services are component building blocks used to construct custom systems. The services are typically used to replace or augment capabilities found in a traditional datacenter. By using these services, developers and admins can do the following:

- Create hosted applications that vary in size, scalability, and high availability, and address global requirements

- Deploy virtual machines to run more-traditional workloads

- Interconnect and integrate cloud and on-premises applications and systems

- Build and deploy complex database and data storage architectures

- Monitor and secure systems, and perform other management functions like backup and disaster recovery

- Exploit state-of-the-art technologies, such as AI, sooner and with less upfront cost and effort.

The level of interest in these offerings varies because many customers use services from competitors, such as Amazon Web Services (AWS) and Google Cloud Platform (GCP) either to replace or supplement Azure services.

Azure Developer and IT Services Licensing and Purchasing Basics

Azure provides dozens of developer and IT services, each licensed via a combination of consumption- and capacity-based charges, with a wide variety of units of measure. Many services accumulate charges until explicitly turned off.

Featured Blog Post

Azure SLAs: What Customers Need to Know

Azure Tiered Service and Add-ons

Generally, an Azure service is available in multiple tiers (for example, differing in performance and capacity) and can be deployed in different geographic datacenters, which can have somewhat different prices. Services can be augmented with add-ons that provide additional capabilities or capacity, such as high availability, premium storage, private networking, and/or customer-controlled encryption keys.

Considering that each customer application is generally built on multiple Azure services, large organizations often see monthly bills with thousands or millions of line items from several thousand possible choice combinations.

Tagging Azure Services for Budgeting

On the positive side, Azure resources can be coded (tagged) to customer cost centers to help with internal budgeting and charging; however, it is up to the customer to develop, implement, and enforce the coding structure. In addition, customers can set alerts for when certain preset cost thresholds are reached.

Annual Azure Spend

Typically, large organizations commit to an annual Azure spend (to qualify for a discount), and all Azure charges contribute to that commitment.

2 Challenges Specific to Azure Developer and IT Services

The major challenges in Azure developer and IT services licensing are twofold: forecasting new solution cost and optimizing ongoing spend.

Forecasting new solution costs before going live is difficult.

This situation is true especially for solutions that use multiple Azure services, which is a typical scenario. Upfront planning, comparing with other existing workloads, and running test deployments can help with forecasts. But often the only way to accurately forecast ongoing Azure expense is to go into production and monitor charges for several months. Therefore, when building project estimates and budgets, customers should realize they are educated guesses and mitigate the risk by including larger financial contingencies than would otherwise be used for on-premises projects.

Optimizing ongoing Azure spend is arguably more consequential than on-premises.

It also requires different processes. Underutilized resources on-premises are generally a sunk cost, but in the cloud, they are an ongoing expense that can often be resolved but only if identified.

Cloud environments tend to grow organically, and most customers find that over time they accumulate underutilized—or even unused—Azure resources that are not properly sized or licensed in the most efficient manner. For example, long-running workloads can sometimes be licensed at a lower cost if a customer is willing to make long-term financial commitments.

Microsoft provides numerous Azure cost management tools to help track costs, but it is up to customers to create systems and procedures (often involving third-party tools or in-house solutions) to turn data into actionable information and identify potential cost-saving opportunities.

Upcoming Microsoft Licensing & EA Negotiation Boot Camp Sessions

This intensive, 18+ hour course provides the most complete, up-to-date Microsoft licensing training available. Get the knowledge and understanding you need to optimize your Microsoft agreements.

The biggest component of your Microsoft spend is also the most challenging to license intelligently.

The Microsoft 365 Ecosystem

Suite Components

Microsoft 365 – and Office 365–related purchases typically comprise the largest part of an organization’s Microsoft licensing costs. These suites consist of components that almost everyone in the organization uses daily—such as e-mail, document sharing, and online meetings—along with the requisite IT infrastructure. For most customers, Microsoft 365 quickly grows into a “circulatory system” of sorts: essential for a myriad of functions across almost every part of the organization and IT infrastructure, and thus almost impossible to replace.

M365 Add-ons

In addition to the base Microsoft 365 and Office 365 suites, there are dozens of associated add-on licenses for additional features like telephony services and geographical controls to meet data-sovereignty and country-specific regulations. The ecosystem also contains development and database tools for power users and IT personnel to write custom applications (mostly labeled Power Apps and Power Automate), often triggering the need for additional add-on licenses.

Featured Blog Post

Paid add-ons to Microsoft 365 are multiplying rapidly. What’s a customer to do?

Microsoft 365 and Office 365 Licensing and Purchasing Basics

Microsoft 365/Office 365 suites are bundles of many discrete components that can, for the most part, be purchased stand-alone, even though it rarely makes financial sense to do so. The components include the following:

- Windows Enterprise (adds technical capabilities and use rights beyond what are shipped with PCs)

- Office applications (Word, Excel, Outlook, PowerPoint, etc.)

- Cloud-only end-user applications such as Teams and SharePoint Online

- Essential back-end security, and legal and regulatory/compliance capabilities.

2 Categories of M365 Suites

Suites, licensed Per-User, come in two categories to accommodate knowledge workers and frontline workers.

Knowledge workers

Knowledge workers are traditional office staff who spend most of their time on computers. They are licensed via E suites (enterprise) and G suites (for U.S. government), which include desktop applications and advanced security and regulatory/compliance features.

Frontline workers

Frontline workers are people who have more modest IT requirements, such as warehouse employees. They are licensed via F suites limited to browser-based user applications.

In addition to purchasing suites, customers often augment their Microsoft 365 and Office 365 deployments with add-ons (Per-User, Per-Device, and capacity-based subscriptions) for several reasons, including the following:

- To create custom applications and processes (using Power Apps and Power Automate) that are more complex than what are licensed in the base Microsoft 365 suites.

- To add other premium capabilities not in any suite, such as longer audit log retention, auto-generated meeting summaries, and Copilot AI assistance

- To incorporate devices and non-human autonomous processes into the organization, such as meeting room phones, kiosks, and chatbots

- To add specific higher-level features to lower-level suites in an attempt to save costs.

Challenges Specific to Microsoft 365/Office 365

Mixing suite levels creates licensing hazards.

Purchasing the lowest-level suite that seemingly meets a user’s needs is a reasonable strategy. However, mixing suite levels is not as cost-effective as commonly believed.

Microsoft does not include functionality that checks whether a user’s current suite includes rights to use particular features, especially higher-end features related to security and regulatory compliance. Furthermore, Microsoft typically does not provide a practical means for organizations to restrict access on their own, further compounding the licensing hazard.

In general, after a new security or regulatory compliance feature is turned on, it is available to everyone in an organization. To head off this license-compliance dilemma, some buyers end up purchasing expensive add-ons for lower-level suites, which negates a large portion of the cost savings they expected to get from mixing suite levels.

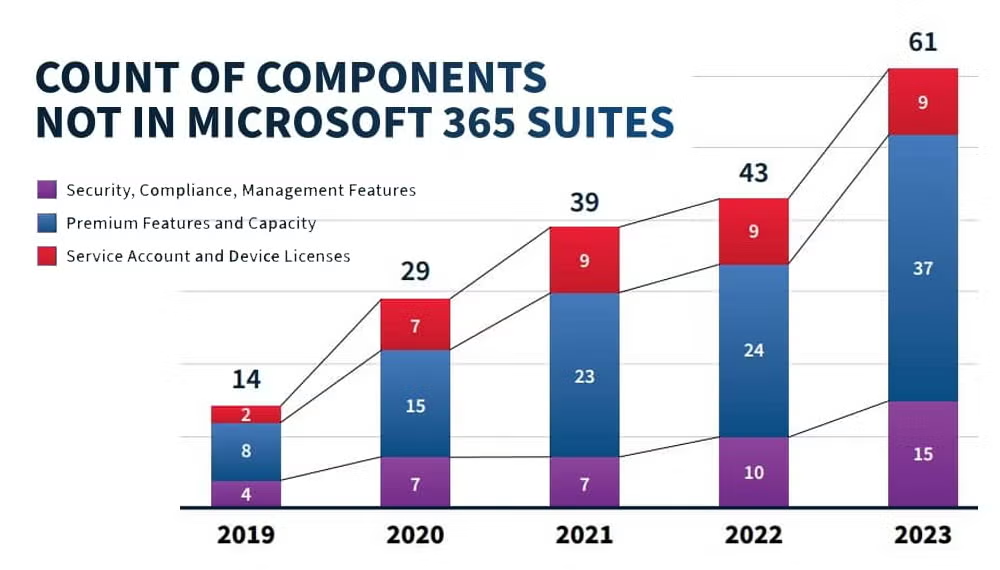

Cost escalation is inevitable.

Customers should expect their Microsoft 365 costs to increase over time, even during the course of their current licensing contract, for the following reasons:

- Newly introduced features are often offered as add-ons rather than being incorporated into existing suites

- In a few areas, such as Power Apps and Power Automate, there is a kind of “network effect,” with increasing use begetting even more use

- Microsoft will exert continued pressure to move customers to higher-level (more expensive) suites across the board, especially if the customer adds a single new suite at the E5 or G5 level

- Negotiation leverage will deteriorate as customer lock-in (the difficulty switching away from Microsoft 365 services) becomes less possible to avoid.

Upcoming Microsoft Licensing & EA Negotiation Boot Camp Sessions

This intensive, 18+ hour course provides the most complete, up-to-date Microsoft licensing training available. Get the knowledge and understanding you need to optimize your Microsoft agreements.

A guide to help you navigate the insanely complex and constantly changing maze of Microsoft licensing rules.

Top 8 Reasons Microsoft Licensing is Complex

Microsoft has a reputation for complex rules that make licensing its products products unreasonably difficult. But it’s not conspiracy and there are reasons.

1. Product Diversity

Microsoft products are foundational tools that most organizations have been using to run parts of their businesses for decades. Microsoft products are on users’ desktops, in the datacenter, in Microsoft’s cloud, and in competitor clouds. Very few vendors have such a wide range of offerings or touch so many users in an organization. Monetizing such a broad product portfolio requires “creativity.”

2. Inconsistency Across Products

One of the most challenging aspects of Microsoft licensing is the lack of consistency across Microsoft’s products. Microsoft consists of largely autonomous business units and no central authority with the power or mandate to impose licensing discipline. Customers dealing with licensing cannot assume the licensing rules for one product apply to other products.

3. Incomplete Licensing Rules

Microsoft tends to release new products before licensing details are complete. Customers who adopt products early may see subsequent licensing changes that negatively impact their budgets. Furthermore, it is not uncommon for the company’s licensing documentation to be out of date or somewhat in conflict with other documentation, or missing details necessary to determine how rules apply to a specific customer scenario.

4. Confusing Terminology

Microsoft is notorious for changing product names, sometimes legitimately, but often for marketing purposes. Similar-sounding names can refer to very different products (see all the different Defender and Copilot services for an endless number of examples). Furthermore, within Microsoft documentation, terms may be used that are never clearly defined or mean different things in different contexts. The same term or phrase can be used to refer to a bunch of different things, or several terms or phrases might be used to refer to the same thing. It can make your head hurt.

5. Multiple Packaging and Purchasing Options

Microsoft has numerous purchasing channels, designed to accommodate a variety of customer types, each with its own payment requirements and licensing conditions. Often, customers need to use more than one purchasing channel to meet licensing requirements and limitations, which adds to the complexity of licensing management. Couple this with multiple packaging choices (for example, suites versus stand-alone; cores versus Client Access Licenses), and an already complex licensing situation gets even messier.

6. Add-on Licenses

Back in the day, when most Microsoft products were on-premises and sold as perpetual licenses, new product features were introduced to entice customers to upgrade to the latest version (i.e., at no extra charge). Now, when most Microsoft products are in the cloud and sold as subscription licenses, new features are introduced as an add-on license. In addition to extra the costs, these add-ons subscriptions create more licensing complexity.

7. Missing Compliance Controls

There is a significant lack of built-in controls to ensure users are compliant with licensing rules in many Microsoft cloud services. The lack of controls means customers often run afoul of the rules, and often the only resolution is to buy additional subscriptions.

8. Tricky Legacy Transitions

Most customers have been purchasing Microsoft products for years, if not decades. This means they have legacy licenses that often need to be converted to modern subscription licenses. There are methods for retaining the benefit of older licenses, but it can require special negotiations, purchasing special transition licenses, and additional tracking and compliance concerns.

Upcoming Microsoft Licensing & EA Negotiation Boot Camp Sessions

This intensive, 18+ hour course provides the most complete, up-to-date Microsoft licensing training available. Get the knowledge and understanding you need to optimize your Microsoft agreements.

Dive Even Deeper with These Free Resources

Podcast: What makes Microsoft licensing so hard? (with Directions analyst Rob Horwitz)

Podcast: The World of Microsoft Regulatory Compliance Solutions (with Directions analyst Barry Briggs)

Podcast: Fourteen years of Microsoft licensing rule changes (with Rob Horwitz and Wes Miller)

Glossary of Documents in the EA contract

EA Contract Stack

What customers refer to as a Microsoft Enterprise Agreement (EA) is actually an interconnected stack of contracts and reference documents. The accompanying diagram shows the most important ones to review and (if possible) amend when negotiating an EA, with the text that follows explaining each in more detail.

The Microsoft Business and Services Agreement (MBSA)

The MBSA is an evergreen document (in effect until terminated by either party) that defines a customer’s business relationship with Microsoft. An MBSA does not oblige a customer to buy anything. However, it is a precondition for entering into an EA or other volume licensing agreement. Among other things, it specifies the rules of precedence among other documents in the contract stack, which types of business units (affiliates) a customer may include, privacy and confidentiality rules, remedies in case of contract breaches, and software license audit rules and procedures.

Enterprise Agreement (EA)

An EA contract records a collection of terms and conditions applicable across enrollments (explained below), such as license duration and rules for license reassignment and transfer. By itself, the EA does not obligate a customer to make any purchases and has no set termination date (it stays in effect until terminated by either party). Important points it covers include which product use rights apply to the agreement, and handling of mergers and acquisitions.

Amendment(s)

Amendments refer to changes made to the agreement after it has been signed. Either party can make these changes and are usually made to accommodate changes in the business environment or to add new products or services. Amendments can be made by adding new terms or modifying existing ones.

Enterprise Enrollment

What most customers consider as “the EA” is the Enterprise Enrollment, and its terms are the single most important part of any EA negotiation process. Also sometimes called a “desktop EA”, an Enterprise Enrollment is commonly used to buy client-side licenses and subscriptions for Windows, Microsoft 365 software and services, and on-premises server applications. The Enterprise Enrollment commits a customer to various purchase obligations, including the purchase of at least one product enterprise-wide, such as a Microsoft 365 enterprise suite. The Enterprise Enrollment also establishes purchase rules and processes, including the annual “True Up” in which the customer audits its systems and places orders for any licenses required to cover growth in the last 12 months. The enrollment also sets price levels, payment terms, affiliate inclusion, and any exceptions granted to product use rights. The term of the Enterprise Enrollment is usually three years: among other things, this means the customer will need to renegotiate any negotiated amendments at the end of this term.

Server and Cloud Enrollment (SCE)

The Server and Cloud enrollment is commonly used to buy server-side licenses and subscriptions for SQL Server, Windows Server, and System Center. Like Enterprise Enrollment, the Server and Cloud Enrollment commits the customer to buy some products enterprise-wide and establishes purchase rules and processes, including “True Up” requirements, price levels, payment terms, affiliate inclusion, and any use rights exceptions. Not every EA includes a Server and Cloud enrollment, because customers can also buy server-side licenses through an Enterprise Enrollment, but the Server and Cloud enrollment can offer superior unit prices for large commitments.

Product Selection Form

A Product Selection Form is a document associated with an enrollment. It lists the types of licenses that will be bought enterprisewide, along with initial purchase quantities and price levels. The resulting prices, including both standard and negotiated discounts, are recorded in a separate Customer Price Sheet for the enrollment.

Customer Price Sheet (CPS)

A CPS records prices an EA customer agrees to pay in an enrollment, including any standard and negotiated discounts. The CPS also records license quantities purchased at the start of the enrollment, as well as country of usage for the licenses. The CPS is typically one of the last documents to be finalized during an EA negotiation, is prone to mistakes, and warrants thorough review.

Program Signature Form

A Program Signature Form is the vehicle by which a customer “signs” legal documents related to most volume licensing programs. Customers do not sign the legal documents themselves, but rather a customer representative signs a Program Signature Form that lists one or more documents being signed, along with their unique identification codes. Every new “signature event” results in a new form, and by assembling all past Program Signature Forms, a customer can identify the documents the organization has signed, and when.

The following documents are not part of the EA contract stack, strictly speaking, but they are referenced by documents in that stack and contain important terms.

Product Terms

The Microsoft Product Terms is an online repository for rules governing product licenses acquired through volume licensing programs. The Product Terms defines each product’s license model, which among other things, defines a set of license types, which devices or users require them, how many are needed, and under what circumstances. It also lists components of suites (such as the Microsoft 365 enterprise suites), The Product Terms is updated monthly, but it is referenced by documents in the EA stack that have longer lifetimes. Consequently, EA documents generally should specify which month’s Product terms apply, so that terms do not change out from under the customer.

Online Service Terms (OST)

Online Services Terms (OST) is a repository for certain types of information specific to online service licenses acquired through volume licensing programs. Service Level Agreement (SLA) for Microsoft Online Services. The OST was merged into Product Terms in February 2021, so it no longer exists. However, it is still referenced in any EA contract signed in early 2021 or prior.

Service Level Agreement (SLA)

The SLA is the most important element of the Online Services Terms. It specifies financial remedies for online services downtime and other incidents, and procedures for claiming remedies after an incident. Customers who actively monitor downtime and have efficient processes for claims can save on service fees. The SLA is not updated on any regular schedule but usually updated two or more times a year. (based on last few years)

Data Protection Addendum (DPA)

The DPA defines privacy and confidentiality terms that will apply to an EA. Regulated customers will need to review it carefully: although it is rarely amended for individual customers, the DPA is revised roughly semi-annually, so customers must also review which version applies to their enrollments and EA. In some cases, amendments elsewhere in the EA stack could address shortcomings in the DPA. The DPA isn’t updated on a regular schedule, but historically, it is updated at least once annually.

What Is Power BI?

Power BI is Microsoft’s cloud service and software for business intelligence (BI). Like other BI systems, it helps business professionals analyze information from production systems and discover actionable “insights.” With Power BI, users can collect and organize source data, build analytic models, and create and share interactive reports, charts, dashboards, and other content for presentation. For example, a manufacturing firm might use Power BI to pull data from its enterprise resource planning, customer relationship management, and production floor monitoring systems to build dashboards that track key performance metrics for each business unit and job role.

Power BI is available in several configurations (in the cloud and on-premises) and has numerous components and features that customers use to build a full end-to-end BI environment. (In early 2024 Microsoft announced the retirement of Power BI Premium P by early 2025. Going forward large customers will need to deploy high-end Power BI environments using Fabric licenses.)

Power BI Competitors

Power BI can be used to replace most existing on-premises BI deployments, including ones that companies have built with Excel and SQL Server’s Analysis Services, Integration Services, and Reporting Services. Major competitors to Power BI outside of Microsoft include Alteryx, IBM Cognos, SAP Business Objects, SAS Visual Analytics, Sisense, Tableau, and Tibco.

Role at Microsoft

Power BI is also used as a reporting tool in several Azure and Microsoft 365 services. In 2023, Microsoft announced plans to make Power BI a cornerstone of its Microsoft Fabric data analytics platform, where it is more deeply integrated with a number of Microsoft’s key data integration and analytic tools. Although Power BI is one of the key components in Fabric, it is also the least changed, which means Power BI customers will see minimal changes to their existing Power BI environments, but will see additional integration with other data sources that are in Fabric’s OneLake data solution. The most notable impact will be the retirement of Power BI Premium P purchasing options in Jan. 2025. Microsoft is pushing Power BI customers to Fabric by making them relicense and redeploy Power BI capacities inside Fabric.

Microsoft announced the public preview of its Copilot AI assistant technology for Microsoft Fabric, including the general availability of Copilot in Power BI. The goal of Copilot in Power BI is to allow customers to use natural language to create reports, analyze data, and generate text summaries with less effort. The preview of Copilot in the other Fabric components is rolling out in stages and will help developers build pipelines, write Spark scripts, and query various databases.

Key Benefits of Power BI

Consolidating BI

Power BI enables organizations to consolidate collecting, storing, analyzing, and presenting data in a single system. Data can come from an enormous variety of Microsoft and non-Microsoft data sources, and customers have a range of cloud and on-premises options for hosting reports and data. Users can access reports through numerous client applications, including Web browsers, Teams, and mobile applications, and in custom and third-party applications that embed Power BI reports. Users and developers can design reports in Power BI’s native format or in legacy report formats from Excel and SQL Server Reporting Services.

This all-in-one-place model has advantages for management, security, performance, and reliability. Consolidating data, analysis, and presentations in a single system reduces the complexity of infrastructure that IT personnel must manage and reduces latency and network-caused outages. It also helps IT personnel to consistently control access and enforce policy.

Cloud Hosting

Customers can host Power BI on-premises, but most customers use the Microsoft-hosted cloud service. This choice offers all the usual advantages of Microsoft cloud hosting: reduced effort to maintain infrastructure, faster scaling of storage and compute resources, an extensive global network of datacenters, and better security and availability infrastructure and people than most companies can afford themselves.

Design

For designing analytic data models, Power BI offers the same semantic data modeling tools available in Excel’s Power Query and Power Pivot components. For creating reports, Power BI provides three key design options: native Power BI format (PBIX) reports, Excel workbooks, and SQL Server reports built with the Report Definition Language (RDLs). PBIX reports deliver interactive, animated, multipage reports using hundreds of visual formats like bar charts, waterfall charts, timelines, and word clouds. Developers can also create their own visual concepts to extend Power BI further. Although Microsoft focuses on the PBIX report format, it has not abandoned its legacy: Power BI can also host Excel workbooks with some limitations and reports created in RDL of SQL Server, enabling organizations to consolidate existing reports with new ones in Power BI and preserve their investment.

Developers normally collect and organize data and design reports in a free Windows desktop application, Power BI Desktop. However, the browser client of Power BI’s cloud service continues to add design features and could eventually take over the role of Power BI Desktop, which would simplify client management and enable Power BI design on Macs and other non-Windows clients.

Application integration

More and more Microsoft apps and services can work with Power BI for reporting and analysis, including Dynamics 365, Project Online, and most Azure services. Excel has a special relationship with Power BI in that it can be used to access Power BI–hosted data, allowing data analysts to continue using Excel. This integration helps ensure that investment in Power BI skills and infrastructure is paid off in multiple Microsoft apps and services.

Evolution and Roadmap

Over the years, Microsoft has steadily increased the maximum size and computing power available to Power BI deployments and improved security, management, and licensing to serve larger organizations. More recently it has been integrating data storage and data integration into Power BI. This development enables organizations to eliminate separate systems to extract, transform, and load source data for analysis directly into the service. In some cases, customers can eliminate other data marts as well, consolidating all BI and support functions in Power BI.

Microsoft is also investing in the Power BI portal (a browser application) so that users can fully edit and update reports in the portal without requiring Power BI Desktop. The company continues to surface Power BI in more apps and services. There are plans for Power BI in Outlook Online and Office Hub and more capabilities in the Power BI app for Teams and Excel Online. Microsoft also has made it a priority to integrate Power BI with OneDrive for Business and SharePoint Online. (These integrations are all with the browser-based online apps and probably won’t come to the desktop applications..)

What is Power BI? video with Directions’ Andrew Snodgrass

Power BI Report Types video with Directions’ Andrew Snodgrass

How It Works: Power BI Components

The Power BI platform consists of several components that work together. These include the following:

Back-end Hosting Platforms

The back-end platforms enable storing and sharing of organized data models, processing data integration pipelines, pulling data from various sources, processing the data to produce (render) reports, publishing and distribution of reports and dashboards, and managing user access. Microsoft offers customers several tiers of Power BI cloud services and one on-premises Power BI Report Server. They vary somewhat in client tools, features, performance, scaling, and security.

Choosing the correct back-end platforms is the single most important decision a customer will make in Power BI adoption or major expansions. The back-end platforms are key to meeting business requirements and are the primary determinant of licensing costs.

Data Management Tools

Power BI data management features are used in combination with other Power BI components as a full-service reporting solution, in some cases replacing existing data integration and reporting products. Source data is loaded into Power BI datasets (also called data models), which are created using Power BI Desktop, Power BI portal, and SQL Server Data Tools.

Most data can reside within Power BI storage, but larger datasets can be offloaded to Fabric OneLake or other Azure services like Azure SQL Database.

Data Integration is provided via Power BI Dataflows, a built-in extract, transform, and load (ETL) component that allows developers to create refreshable data pipelines to bring data into Power BI. Microsoft built this dataflows feature using Power Query, so it’s familiar to users of Power BI Desktop and Excel.

Data Connections

Power BI also provides connectors, or gateways, for querying data used in datasets, dataflows, and reports that are loaded from source systems such as financial software and production logs. The data can be stored in the Power BI service or remain in the external source and be queried as needed. There are connectors for Azure data services, like OneLake and Azure SQL Database, and data gateways that connect to on-premises data sources.

Report Design Tools

Power BI content is created and shared using a variety of tools. Content can include datasets, data integration pipelines, reports, dashboards, metrics, Excel files, and traditional SQL Server Report Definition Language (RDL) tabular reports. Content creators, who may be business analysts or software developers, typically use Power BI Desktop, SQL Server Report Builder, or Excel, depending on the task, to design the content. Increasingly, content creators use the Power BI portal browser interface. Software developers can also use SQL Server Data Tools in Visual Studio for RDL reports.

Content creators can also create Power BI apps that bundle certain content together for specific groups of users. For example, a Power BI app for the financial forecast team can contain (point to) just the relevant reports from the hundreds of financial, sales, and production reports that an organization may have, helping users find the reports they need.

Power BI Desktop

Power BI Desktop is the primary tool for building Power BI (PBIX) reports. It is a free Windows desktop application that contains data modeling capabilities and a report design canvas. Authors create reports (saved locally as .pbix files) using various visuals like bar charts, waterfall charts, timelines, and word clouds.

The product includes several visual types, but authors can purchase third-party solutions or build their own visuals to extend the service. Authors use other Desktop features to allow users to filter and slice data for performing data analysis and to guide users through pages of data. The tool also provides links to other Microsoft-hosted services, like Azure Machine Learning and Power Apps, that authors can use to perform advanced and custom data processes. Authors typically use Power BI Desktop to publish reports directly to a Power BI back-end platform.

Power BI Portal

The portal provides a growing subset of Power BI Desktop’s dataset and report-building features for creating PBIX reports. The portal lacks some of the canvas design tools and the advanced data query and data modeling features found in Power BI Desktop, which limits the ability to query and transform data from multiple sources. Consequently, the portal’s design features are often used to create basic reports in a Web interface without using the desktop tool, although Microsoft is investing heavily to build more functionality into the portal. A more robust portal application could remove the need to use Power BI Desktop, a benefit for MacOS and Linux users.

Excel

Microsoft’s Excel spreadsheet is used to create Excel workbooks. It is a familiar tool to most data analysts and has been used for many years as a reporting tool to build workbooks with tables, charts, and data models. Most Power BI back-end platforms can host Excel workbooks (.xlsx files) from current versions of Excel.

Power BI Report Builder

Report Builder is a free Windows desktop client used to create paginated reports based on SQL Server Reporting Services Report Definition Language (RDL). RDLs are traditional data-driven business and operational reports, such as monthly cost reports and annual financial statements, that were the dominant reporting option at Microsoft for years until the introduction of Power BI. The tool is based on SQL Server Report Builder and is updated frequently (sometimes monthly) to stay in sync with Power BI services and to add features that are supported only when the RDL is used in a Power BI cloud service.

SQL Server Data Tools

This is a toolset in Visual Studio where developers create databases, data models, and RDL reports. RDLs created with SQL Server Data Tools can be manually copied to a hosted Power BI service, providing a migration path to the hosted services.

Clients

Content consumers, who just view and interact with Power BI content, can use a variety of clients, including the Power BI portal, mobile applications, a Teams-based app, Microsoft 365 services, embedded Web sites, and custom applications. The clients provide interactive features like filtering and drill down. The portal enables basic report creation and provides additional organization, collaboration, and analytic features.

What is the Cost of Power BI?

Power BI licensing costs are determined by the back-end platforms that the customer chooses to host data and reports and the number of user licenses required, which depends on the back-end platform.

Back-End Platforms

The back-end platforms include four tiers of cloud services and one server software product for deployment in customer or third-party data centers.

Power BI Free is mainly for individual users and is generally unsuitable for business use because of its lack of security controls and collaboration, limited storage capacity, and other significant shortcomings.

Power BI Pro offers most Power BI features and is designed for organizations that do not need high-end security or global distribution and generally have relatively few users, typically fewer than 500. It is also used by an organization that licenses users with Microsoft 365 E5, which includes a Power BI Pro User Subscription License (SL).

Fabric licensing is replacing the existing Power BI Premium P, which retires on Jan. 1, 2025. Fabric licenses Power BI usage differently, depending on the Fabric performance level:

- The lower Fabric SKUs (F32 and below) do not include Power BI rights. However, users can still work in a Fabric workspace using Power BI Pro, which requires separate Power BI Pro licensing.

- The higher Fabric SKUs (F64 and above) include a traditional Power BI Premium P deployment with all the advanced geo-distribution, security, and large data models that were in a Premium P SKU. It also includes licensing for read-only (consumer) users with only content creators requiring separate Power BI Pro user licenses.

Power BI Premium Per-User is a user-based service that provides most of the features of the high-end solution not available in Power BI Pro. The platform is typically for deployments with fewer than 250 users, like a regional office or development team. Above this amount, higher-end Fabric subscriptions typically find a lower per-user cost.

Power BI Premium EM Azure Power BI Embedded is designed for organizations that want to share Power BI reports with internal users through their own custom applications and Web sites. It includes most high-end features of the previous Premium P environment but does not provide access to the Power BI portal or mobile apps. The service is licensed by capacity with tiers ranging from EM1 to EM3 that differ by the number of virtual cores.

Azure Power BI Embedded provides the same features as Premium EM but is designed for organizations that want to share Power BI reports with external users through their own custom applications and Web sites. Sharing externally requires the customer to provide their own user authentication solution. The service is licensed by capacity with tiers ranging from A1 to A8 that differ by the number of virtual cores.

Power BI Report Server is a special edition of SQL Server Reporting Services that can host Power BI (.pbix) reports. It can be licensed with SQL Server Enterprise edition with active Software Assurance or through dual-use rights provided by high-end Fabric SKUs (F64 and higher) purchased through capacity reservations. The dual-use rights allow customers to have a Power BI cloud deployment and deploy Power BI Report Server on-premises using the same number of equivalent cores included in the Fabric capacity concurrently.

Purchasing Options

The Power BI branded back-end platforms are purchased primarily in monthly increments with a discount for larger customers willing to make annual commitments. However, the Fabric subscription can be purchased either through capacity reservations that mimic the older Premium P subscriptions in price or through pay-as-you-go licensing that has a higher rate, but is more flexible and does not have an annual commitment.

Platforms and License Models

Power BI provides several Per-User and capacity-based licensing models. The precise licensing requirements depend on the back-end platforms being used and—in some cases—on the features the organization requires.

Per-User Only

Power BI Pro and Power BI Premium Per User platforms require a User Subscription License (User SL) for every user accessing content hosted on them. These platforms will make financial sense for smaller deployments: up to 500 users for Pro and 275 users for Power BI Premium Per User, because beyond those levels the high-end Fabric options offer a lower cost per user for Power BI usage.

Capacity and Per-User

Fabric and Power BI Report Server use a mix of Per-User and capacity licensing. Organizations using these platforms pay for a specific capacity level (much like virtual processor cores). Fabric offers two purchasing methods, pay-as-you-go (PAYG) and Reserved Capacity. PAYG has hirer prices than Reserved Capacity but may be a lower cost choice for development teams and groups that can pause the capacity overnight when not in use.

User SLs are always required for content creators – report authors, data specialists, and administrators who build and share content through a Power BI back-end platform. User SLs may not be required for content consumers (usually the largest group of users), who view and interact with reports or create reports for their own use, although it depends on the deployment size. In general, consumers require a Power BI User SL, except in cases where the content is shared from a high-end Fabric capacity (denoted as an F64 or higher).

User License Compliance Notes

Power BI cloud services enforce User SL requirements, simplifying license compliance for customers.

For example, if a Power BI report is shared from a Pro or Premium Per User workspace, then the content consumer needs a Pro or Premium Per User subscription because those platforms require User SLs. If the content is shared from a high-end Fabric platform (F64 and higher), then the content consumer does not need a User SL.

However, Power BI licensing rules also follow where the data is hosted, which can complicate matters further. For example, if a Power BI report is shared from a high-end Fabric platform, but the data the report reads is on a Power BI Pro platform (a common occurrence), then the content consumer needs a User SL even though the report is shared from a high-end Fabric deployment.

Bundled Licenses

Users get rights to access Power BI Pro with a Microsoft 365 Enterprise E5 User SL. These rights can be valuable if a company has bought E5 User SLs for security, compliance, or other reasons and intends to deploy Power BI Pro. However, if a company buys Microsoft 365 E5 enterprise wide and then deploys Power BI through Fabric with capacity-based licensing, it will likely end up with many unused Power BI Pro User SLs because only content creators, not content consumers, require Power BI User SLs for content hosted in the high-end Fabric deployments.

Top Tips and Tricks for Power BI

1. Back-end first

Choosing the correct combination of back-end platforms is key to meeting business requirements and controlling costs. The back-end platforms dictate features, capacity, performance, scalability, security, and licensing. Before committing to Power BI or greenlighting a major expansion, customers should review the options for back-end platforms, particularly in the following areas:

- Capacities and performance (high-end requirements typically lead to more cost)

- Advanced features (like tabular data models and geo-distribution)

- Data hosting (more storage is available with high-end Fabric deployments)

- Licensing

2. Consider data integration and storage, not just reporting.

Power BI started life as a reporting system, and that is still its most important role. But it has steadily added storage and data integration options. Each high-end Fabric instance (which includes a Power BI Premium component) receives 100TB of storage and can process data models up to 400GB, which means customers can host some decent-sized data in Power BI. Additionally, the data can be accessed by outside tools, like Tableau, so it’s not walled off from other applications. Customers can put that data in Azure SQL Database or somewhere else, but with high-end Power BI deployments the storage cost is already included. Additionally, hosting and querying data do not require a separate SQL Server license. Customers may be able to retire legacy data marts and supporting data integration systems on-premises by moving them to Power BI, improving security, performance, and cost.

3. Buying PAYG Fabric F SKUs can be more cost effective.

Choosing PAYG Fabric F SKUs can be more cost effective than capacity reservations. Fabric, unlike previous Power BI options, is available through two purchasing methods: pay-as-you-go (PAYG) and capacity reservations. Generally, consistent long-running deployments should be purchased with a capacity reservation, which provides a lower-cost in exchange for a one- or three-year commitment. However, PAYG might be a better purchasing option for deployments that can be scaled down or paused on a regular basis. For situations like dev/test or single location deployments, where a capacity runs for less than 14 hours per day (and can be paused), it will be less expensive to purchase through Fabric PAYG options, at any performance level.

4. Use dual-use rights to lower on-premises costs.

There is a licensing benefit that will most likely appeal to organizations planning a hybrid deployment, with some reports hosted in high-end Fabric SKUs (F64 and higher) and other reports hosted on-premises, using Power BI Report Server. Power BI Report Server can be licensed using SQL Server Enterprise edition core licenses with active Software Assurance or with dual-use rights provided by a high-end Fabric subscriptions purchased via capacity reservations. These subscriptions provide on-premises rights that allow customers to deploy Power BI Report Server on local hardware with the same number of cores included in the Premium P subscription, which may help reduce on-premises licensing costs.

5. Don’t overestimate Microsoft 365’s bundled Power BI.

Microsoft 365 Enterprise E5 delivers rights to Power BI Pro that can be valuable for smaller firms. But larger ones will often opt for high-end Fabric deployments that leave those rights on the shelf. Large organizations that have bought Microsoft 365 E5 for security and compliance reasons should use the included Power BI Pro User SL rights they get where the rights are useful, but Power BI Pro rights should not be a factor in deciding to buy Microsoft 365 in the first place.

Where Do I Start?

“I wish someone had told me that before we got started.”

Microsoft technologies are likely already an essential part of your organization’s IT operations. It’s a dependency that puts you at risk in two big ways. First, you’re subject to escalating costs linked to the constant need for newer and more expensive sets of Microsoft technologies. Second, you’re under the never-ending threat of a Microsoft audit for license non-compliance – something it won’t hesitate to do whenever it needs to feed its relentless revenue-growth engine.

To keep these risks contained, you need to understand Microsoft licensing.

For a variety of reasons, Microsoft doesn’t make licensing easy. Doing so is not important to Microsoft executives. It’s not even on their radar. (See “Why is Microsoft Licensing So Complex?”) But at Directions on Microsoft, making Microsoft licensing comprehensible, and giving customers the knowledge, insight, and coaching they need to stay compliant and control costs, IS our mission. It has been for more than 30 years.

That’s why we have crafted this overview (download as pdf), at a roughly 200-level of how Microsoft licensing works. It’s a sample of what we do here.

Our explanation of Microsoft’s licensing structure and rules doesn’t require prior experience or an in-depth knowledge of the products, technologies, or services that are covered. You won’t be a Microsoft licensing expert after reading this, but you will be a lot smarter and savvier about approaching Microsoft licensing and much better equipped for conversations with your IT, procurement, and legal teams—and in addition with your Microsoft account reps or reseller partners.

Licensing Fundamentals

Customers never “own” Microsoft software or services. They license the right to install, run, and use them.

The terms and restrictions that apply to these licenses cover a lot of ground.

They can determine permitted substitutions, such as the ability to install and use older product versions. They can limit your ability to move licenses between users and devices as your needs change. They can restrict purchase of less expensive licenses to only those users who meet strict criteria. They may establish prerequisites for upgrades or scenarios that don’t require licenses (such as for external users).

Licensing Yin and Yang: Rules and Programs

In this Deep Dive on licensing basics, we are focusing on “licensing rules,” not “licensing programs.” Rules and programs are like the yin and yang of Microsoft licensing. The rules determine which licenses an organization needs to buy to perform specific tasks. The yang is license programs—the contract types Microsoft creates to allow customers to buy its products. There are many different contracts because of the wide variety of customer types (government, for-profit, non-profit, academic), organization sizes, and delivery channels.

Although your choice(s) of licensing programs will have some effect on how you negotiate, transact, administer, and interface with Microsoft and its partners, they will have minimal impact on the licensing rules. And it’s important to understand the rules before engaging with licensing programs.

Some Key Definitions

Below are some terms worth understanding before we dive into licensing rules.

Product

In the context of this article, a “product” is any Microsoft-hosted online service or Microsoft-authored software that the company sells to organizations.

Access (or “use”)

This describes the case via which a user, client device, or autonomous code interacts with a Microsoft online service or software. This access usually triggers a licensing requirement (one occasional exception: narrowly defined use cases by non-employees). Though not explicitly defined by Microsoft, “access” is used very broadly by the company to include any type of read, write, or create operation. Rule of thumb: if you are wondering whether a particular scenario constitutes “access” (and thus requires purchasing licenses), assume it does unless Microsoft unequivocally states otherwise.

Online services

Online services are powered by Microsoft-authored code running and maintained within Microsoft’s datacenters. Exchange Online, which provides e-mail and calendaring, is a popular example. Although customers might expect Microsoft’s online services to enforce license compliance—in other words, to automatically restrict use when customers have the wrong type or an insufficient quantity of licenses—this only sometimes is the case. For many online services, or components within online service suites, monitoring and maintaining compliance is the customer’s responsibility.

Software

Software is Microsoft-authored code that can be installed and executed on a customer’s own hardware (“on-premises”) or “in a cloud,” which includes virtual machines hosted at third party service providers. Software product examples include Microsoft Word and SQL Server. Only with limited exceptions does Microsoft software enforce license compliance.

Durability of rights

Durability of rights is a high-level attribute that separates subscription licenses from traditional perpetual licenses. Subscription licenses are roughly the equivalent of renting an asset with ongoing financial obligations. Perpetual licenses provide a customer with a continuing right to use a product after paying for it once.

Subscription Licenses

Subscription licenses require an ongoing payment and provide rights to use a product or service only for as long as the subscription fee is paid. They are always used for online services and sometimes required for software products run on-premises, such as the latest versions of SharePoint Server. Subscription licenses are much like entering a lease and generally represent an operating expense (opex).

Many subscriptions require a minimum duration commitment, ranging from one month to many years, depending on product and purchase agreement type. Others have no set duration requirement, with charges ceasing to accumulate as soon as the customer stops her/his use of the service.

Perpetual Licenses

Perpetual licenses provide the right to use a product in perpetuity (though they don’t offer any guarantees around support in perpetuity) and are tracked as an asset, or capital expense (capex) on the corporate balance sheet. Perpetual licenses are available for most Microsoft software but never for online services. Microsoft is slowly but consistently phasing out existing perpetual licenses and replacing them with subscriptions.

On customer orders, perpetual software purchases are typically noted as “License-only” (with fee paid upfront); license combined with one to three years of Software Assurance (see below) coverage (“L&SA,” paid either upfront or divided across multiple annual payments); or “SA-only” (typically an annual payment).

Software Assurance (SA)

Software Assurance (SA) is a subscription-based add-on to a perpetual license. SA adds rights to new software versions—and for some products, rights to deploy the software in specific scenarios. Be warned: customers can end up paying for “new version rights” for a product even when no new version ever arrives during their coverage period. SA also can limit when and how customers can cut back on purchase volumes if needed.

Podcast

Microsoft Licensing Boot Camp Lessons Learned (with Directions analyst Wes Miller)

4 Licensing Units of Measure

Microsoft has four main licensing units of measure that determine how customers are charged. These four—Per-User, Per-Device, capacity-based, and consumption-based—are used across Microsoft product types and purchase agreements. For some products, two or more measures are used to assess fees, and in some cases, customers may have the ability to select which unit of measure, or combination of measures, they prefer to use.

1. Per-User Licenses

Per-User licenses are priced per individual person and provide the right for that individual to access a product or service, typically from any device. For example, a Per-User license for e-mail is assigned to one person, allowing that person to access her/his account and e-mail from any device. The two commonest Per-User licenses are User Subscription Licenses (User SLs), mostly for online services with prices quoted per user per month, and User Client Access Licenses (User CALs), used for traditional on-premises server products with prices quoted in a variety of forms (see “Perpetual licenses” paragraph above).

Per-User works like a gym membership, in which users are charged per month and have picture ID cards entitling them (but not their friends or family members) to use the facilities whenever they want.

2. Per-Device Licenses

Per-Device licenses are charged by device, either a client device or server. In the case of a client device such as a PC, a Per-Device license provides the right for any user to access the associated product through that device. For example, Per-Device licenses are often used for sharing customer relationship management (CRM) software on call-center computers across shifts. The two commonest Per-Device client licenses are Device Subscription Licenses (Device SLs), used for online services with prices typically quoted per device per month, and Device Client Access Licenses (Device CALs), used for traditional on-premises server products with prices quoted in a variety of forms (see above). The second form of Per-Device licenses are server licenses, which provide the right for a physical server to run a particular server-based product, such as SharePoint Server.

Think of Per-Device like home-gym equipment. You buy it, and anyone you allow can use it.

3. Capacity-based Licenses

Capacity-based licenses provide the right to use a product or service up to a specified resource limit, with prices quoted based on some type of size metric. One example is a cloud service that is powered by a predefined number of processor cores and amount of memory and pre-allocated storage. A second example is a physical server (or virtual machine) running Windows Server and SQL Server utilizing a set number of computer processor cores. Although capacity-based licensing requires the customer to calculate a usage high-water mark (and pay the same amount regardless the level of use), it also helps cap the cost of using the product.

Capacity-based is like an add-on to your gym membership that allows you to sign up for and attend any number of yoga classes the gym hosts during a given month. But you still must pay if you don’t go.

4. Consumption-based Licenses

Consumption-based licenses, unique to cloud services, provide the right to use a service with charges based on how much of it is used, similar to the way utilities charge for electricity. Consumption-based services are charged using various measures and increments often unique to the specific service. For example, Azure Storage charges monthly for the number of GBs of space required to store customer data. Other services, such as Azure Machine Learning, charge based on the number of hours required to complete a specific task.

Consumption-based is similar to drop-in gyms, where users only pay a fee when they go in and work out.

Video

Directions Cofounder Rob Horwitz explains Microsoft’s 4 Licensing Units of Measure.

Licensing Models

Licensing models are frameworks where everything is brought together. License models determine how a customer is charged for using a product or service and the terms governing its use. Microsoft license models vary by product and service with each having its own nuances, making budgeting, purchasing, and compliance challenging.

In general, a license model for a product or service does the following:

- Defines the applicable license types used (Per-User, Per-Device, capacity, consumption)

- Specifies how the quantity of each license type is determined, including special cases where no license or a special category of license is required

- Provides formulas for calculating capacity– and consumption-based charges

- Enumerates purchase prerequisites (for example, a dependency on one or more other products)

- Defines boundaries for usage and installation (for example, the maximum number of installations allowed)

- Details when substitutions are permitted (for example, the right to deploy a previous version).

Most Microsoft products and services can be grouped under three main licensing model categories: online services, desktop software, and server software.

Avoid Costly Mistakes with Directions’ Microsoft Advisory Services:

EA Negotiation Support

Microsoft Strategy Assessment

Self-Audit and Audit Defense

Expert Desk

Microsoft sales, negotiation, and audit tactics are highly effective at leading customers to overspend. Directions Advisory Services level the playing field.

Online Services

Delivered via Microsoft’s cloud, online services include:

- Applications for e-mail,

- Customer relationship management (CRM),

- Enterprise resource planning (ERP),

- Business reporting, and

- Services for developer and IT management that collectively can replace traditional on-premises datacenters.

Shared Online Services Licensing Challenges

The following are licensing challenges shared across all Microsoft online services, though each service also has its unique licensing risks.

Predicting costs inaccurately.

Before going live, customers find it difficult if not impossible to accurately forecast costs for a new solution, especially for solutions that use multiple Azure services, which is common. Often the only way to accurately forecast ongoing cost is to go live in production and monitor charges for several months.

Further complicating matters, a growing list of online services provide users with the ability to purchase plans on a credit card (self-service), bypassing internal purchasing processes. Although IT personnel can turn off self-service purchasing, monitoring these capabilities requires continual vigilance.

Losing negotiation leverage.

After they are heavily invested, customers often determine that leaving Microsoft’s cloud is a monumental and expensive undertaking. Over time, “walking away” becomes a less and less credible negotiation gambit, degrading a customer’s ability to negotiate favorable pricing and other licensing terms.

Paying for unnecessary services.

Cloud environments tend to grow over time, and most customers find that they accumulate underutilized resources that are not properly sized or shut down or that are not licensed in the most efficient manner. For example, customers might have leftover VMs running in a test environment or Azure storage that is not properly cleaned up. It is up to customers to create systems and procedures to review deployments on a routine basis and identify potential cost-saving opportunities.

With on-premises systems, customers are often forced to make deliberate decisions (such as acquiring additional hardware) when they hit processing power, storage, and other limitations within their datacenter. Not so with the cloud, given its essentially unlimited resources.

Running afoul of license tracking and compliance.

Many Microsoft cloud services—especially Microsoft 365 and Dynamics 365—lack sufficient built-in license controls to ensure organizations are compliant with licensing rules. Cloud services—particularly Microsoft 365’s tools for ensuring security and regulatory compliance—often do not have software mechanisms to track license usage and compliance, which can lead to organizations running afoul of the rules. The only resolution is to buy additional subscriptions for all affected users if in doubt about compliance.

Although Microsoft’s main concern to date has been growing customer adoption, if history is any guide, Microsoft eventually will focus on license compliance to maintain revenue growth.

These services, for the most part, are horizontally focused, covering a broad range of functionality that almost every organization needs. However, Microsoft does provide some industry-specific offerings and a partner ecosystem that can tailor services to specific use cases.

Online services, always licensed and sold as subscriptions, are licensed via some combination of Per-User, Per-Device, capacity-based, and consumption-based measures, with each service often having its own nuances like product-specific licensing prerequisites.

The Big Three Online Services Licensing Model Categories

Online services fall into three general categories, each with its own distinct licensing models and associated licensing challenges. The big three are as follows:

The Microsoft 365/

Office 365 Ecosystem

A set of end-user applications and supporting IT infrastructure.

- Productivity Apps

- Collaboration

- Management

- Security

- Compliance

Business Services and Tools

Dynamics 365, the Fabric data-analytics platform, and Power BI.

- CRM

- FinOps

- Business Intelligence

Azure Developer and IT Services

Building blocks used to construct custom applications.

- Compute

- Networking

- Analytics

- Management

- Data

Desktop Software Products

Desktop software products are installed on an end user’s computer or within a server-based desktop and include Windows client operating systems (OSs), Office suites (the main applications being Word, Excel, Outlook, and PowerPoint), Project, and Visio.

Desktop Software Licensing and Purchasing Basics

Many organizations deploy a combination of “traditional” desktop software products, initially shipped in the 1980s and 1990s (with successive version upgrades since), and “modern” software, first introduced in the 2010s. Although visually they look the same, they have different licensing rules, and licensing one category does not cover use of the other.

“Traditional” desktop software products are typically sold as Per-Device perpetual licenses.

They include versions of Office Professional Plus or Standard (Office suites), Project, and Visio. These products are updated every few years and installed by users or IT professionals, usually on PCs.

Microsoft is gradually phasing out purchasing through perpetual licenses and is working to convert customers to similar products licensed exclusively by subscription. Gradual is the key word here; as long as large and influential organizations continue to require perpetual products, Microsoft seems willing to continue to make them available. For example: Microsoft recently committed to delivering at least two more perpetual versions of its Office suite.

For traditional desktop software, license compliance is not built in, which means customers must create some form of audit process, usually involving a significant amount of manual effort.

“Modern” desktop software is offered exclusively by subscription, almost always Per-User.

So-called modern desktop software includes Windows Enterprise, Microsoft 365 Apps for enterprise (Word, Excel, Outlook, PowerPoint, and others), Project Online, and Visio Online. These products are automatically updated by Microsoft monthly or yearly with no option to remain on an older version for a significant length of time.

In most cases, modern desktop software has license compliance built in, preventing most forms of abuse. Most application subscriptions also provide browser-based Apple and Android applications, allowing remote or traveling users to access applications and content.

Challenges Specific to Desktop Software

Among the most challenging aspects of desktop software licenses, especially for large enterprises, is understanding how to license server-based desktops—especially when it comes to the rules about where the remote desktop is hosted.

Server-based desktops are an important deployment option that provides a secure work area for remote users and reduces the need to deploy applications to local computers.

But Microsoft complicates matters by introducing differing rules based on where the remote desktop is hosted (on-premises, in Azure, AWS, or other provider), which often makes it more restrictive and expensive to host environments on competitor clouds.

Server Software Products

Server software is installed on physical servers and/or virtual machines (on-premises or hosted in the cloud) and can be accessed by multiple users and/or applications. Whether installed in the customer’s own datacenter or at a service provider’s location, these server applications include Windows Server, SQL Server, Exchange Server, SharePoint Server, and System Center.

Server Software Licensing and Purchasing Basics

Server software (whether perpetual or subscription) is governed by licensing models that generally have a two-tier license structure, with separate licenses for servers and clients (end users or client devices), with some minor exceptions:

Server-side Licenses

Server-side licenses provide the right to run the product on the server hardware. They use a per-server or capacity-based fee, with capacity being the number of cores within the physical server or used by the virtual machine.

Client-side Licenses

Client-side licenses provide the right for clients to access the server product. The license types supported are Per-User and Per-Device (for shared devices), with some ability to mix the two types. Per-User client access licenses are available separately or bundled in other packages like Microsoft 365 suites. However, client-side licenses are not always required; for example, when SQL Server is licensed under a per-core license model.

Server software can be purchased perpetually or through subscriptions.

Perpetual licenses

Perpetual licenses for server products are purchased with an upfront fee, along with a subscription option, called Software Assurance (SA), which augments the license with various use rights, such as the right to new versions. Windows Server and SQL Server with SA include additional cost-saving benefits when the software is deployed in Azure.

Subscription Licenses

Subscription licenses for server products, by comparison, can reduce upfront costs and include all SA benefits; however, they do not provide durable perpetual rights.

5 Challenges Specific to Server Software Licensing

Server software licensing can be complex for a variety of reasons that often have far-reaching purchasing and design impacts. A few examples are as follows:

- Multiple types of server-side license models can complicate matters. Users need to understand how per-server, per-instance, and per-core licenses vary across server products. Windows Server and SQL Server, for example, force customers to choose between two or more server-side licensing options.

- SA is required for a number of key capabilities, such as the ability for licenses to cover virtualized workloads that move between physical hosts and to cover workloads on shared hardware at cloud providers.

- Rules can vary depending on where the server software is deployed. Customers have options: on-premises, Azure, AWS, Google Cloud Platform, or other clouds. Unsurprisingly, the best deals are available to those who choose Microsoft’s solutions, especially Azure.

- Substitution rules are complicated. Rules may allow a given server license to cover a previous version and/or lower edition, complicating reconciling use with licenses owned.

- License compliance can be particularly challenging because server software lacks built-in controls to ensure or measure compliance.

Most organizations run a mix of deployments with server software on-premises, in remote offices, in Azure, and in other clouds. As a result, it is up to customers to develop and maintain their own systems to do the following:

- Understand what licenses they own and rent, including the versions, editions, and license models

- Create and maintain an inventory of all deployments, across multiple on-premises locations and clouds

- Reconcile what licenses can be used for which deployments.

What’s in it for us?

Why are we freely giving away all this Microsoft licensing knowledge?

Licensing isn’t “fun” (at least for most people we know). But it’s a topic customers must understand to head off financial and other risks.

Directions on Microsoft is an information and advisory service, meaning we make money by helping customers with their licensing and negotiation questions. We believe there are major opportunities to help customers by simplifying and clarifying the rules and helping connect the dots.

If you want to learn on your own and stay up to date with what’s happening in the Microsoft licensing world, we have you covered with our monthly Update, Licensing Reference Set wiki, Webinars, and more.

If you want a structured learning environment, we hold multiday licensing bootcamps that let you dive in, whether in person or virtually, roughly every six to eight weeks.

If you want advisors—people who will be at your side to help negotiate, assist with an audit, or answer thorny licensing questions one-on-one—we can help with that, too. We routinely handle licensing issues across geographies, industries, and customer types. You may have done a Microsoft licensing negotiation or two. We’ve done hundreds and hundreds.

Directions can’t prepare you 100% to take on the daunting world of Microsoft product licensing. But we can help you get smarter about preparing for and managing it.

Your Checklist

- Educate yourself about key Microsoft licensing rules and concepts.

- Don’t assume consistency. Each Microsoft product and purchasing program brings its own licensing quirks.

- Focus your attention on the Big Three Microsoft licensing categories: online services, desktop software, and server software.

- Understand your organization’s risks and opportunities around Microsoft costs, negotiation leverage, and licensing compliance.

- Engage experts for major MS licensing events such as contract negotiations and audits.

- Don’t give up. Microsoft licensing isn’t fun or easy, but familiarizing yourself with the basics will pay off.

The Basics of a Microsoft EA

Enterprise Agreements (EAs) are the most common way for large companies to license the full spectrum of Microsoft’s software and services.

EAs typically provide customers with discounts on their Microsoft software and services, more predictable long-term pricing, lower compliance and purchasing overhead, and the possibility for customized terms and conditions. There are many pitfalls and risks that can lead to unanticipated expenses later down the road. But the rewards of a good EA negotiation invariably come to those who are well-prepared.

What Are the Particulars of an EA?