February 26, 2026

BlogYour Next EA Renewal: How to Avoid the Financial Cliff

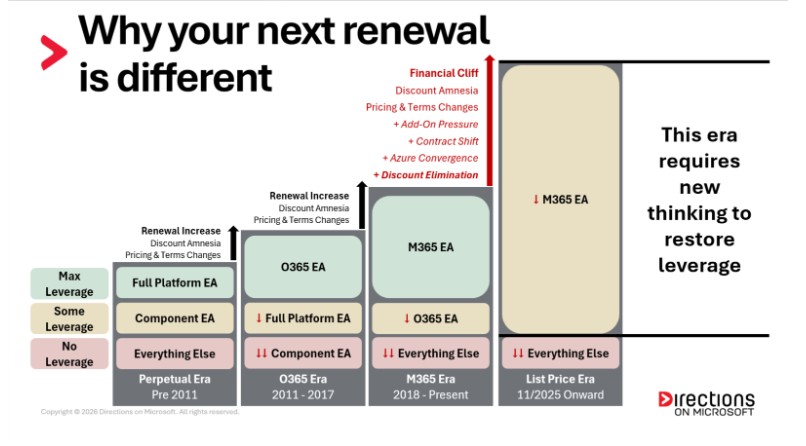

For years, Enterprise Agreement (EA) renewals have been high-stakes exercises. They required preparation, modeling, and disciplined negotiation. Even in their difficulty, renewals followed a familiar rhythm. Controlling costs required real work. You anticipated pricing pressure. You expected negotiation friction. Renewal season was a battle, but it was a battle you had seen before. You understood the terrain.

Now the terrain itself has changed.

Over the past several years — and especially since the November 2025 elimination of subscription volume discounts — the commercial structure underneath EA renewals has shifted. What used to be a gradual slope of increases is now a sharper step. The ladder customers once climbed, trading deeper platform alignment for improved leverage, has fewer rungs.

Consider the pattern many enterprises have lived through. Imagine your EA cost $100 per year in the perpetual era. You negotiated a Full Platform EA because it offered the most leverage available. When renewal came, Microsoft introduced Office 365. You were told the Full Platform construct no longer carried the same commercial weight. You could keep it, but it would now cost $130. Or you could move into the subscription model for $115. You moved. At the next renewal, Microsoft introduced M365. O365 would now be $145, but M365 could be had for $130. You moved again.

Later, M365 E5 became the new strategic tier. Discounts on E3 softened; E5 became the lever. You traded up. Each time, the increase felt manageable because there was something to move toward. There was always another rung on the ladder. Today, many organizations have reached the top of that ladder, and in the post–volume discount era, there may not be another rung to trade for leverage.

The New Layers of Pressure

All the usual negotiating challenges still exist. But over the past few years, Microsoft has layered on new ones.

- Add-On Pressure

M365 E5 was positioned as the flagship — the suite that had “everything.” But over the past several years, Microsoft has increasingly introduced high-value capabilities as paid add-ons rather than bundled enhancements. Teams Premium, Intune Suite, Copilot, Entra ID Governance, Power Platform capacity, Viva modules. And the list continues to expand. Even organizations already on E5 often find that experiencing the full M365 ecosystem now requires E5 plus significant incremental spend.

- Contract Shift

Agreement structure is no longer a background detail. Microsoft has been encouraging some customers toward Cloud Solution Provider (CSP), while moving others into direct Microsoft Customer Agreement for Enterprise (MCA-E) agreements, and reshaping engagement models for large enterprises. These agreement vehicles carry different pricing mechanics, partner dynamics, and usage implications. Renewing into “another EA” is no longer automatic, and structure itself has become a strategic lever.

- Azure Convergence

More functionality is now monetized through Azure consumption meters rather than traditional licensing. Expanded capacity, AI workloads, security telemetry, and data governance capabilities often flow into variable, usage-based billing. These costs are harder to forecast and easier to underestimate, especially when they originate inside the M365 ecosystem but surface in Azure spend.

None of these layers alone creates a crisis. But when you stack them on top of traditional renewal pressures, and then remove the structural volume discount tiers, as Microsoft did in November 2025, the math changes. For many organizations, especially large enterprises, it could feel like a steep change. A material shift in annual Microsoft run rate that cannot be absorbed casually.

That is the Financial Cliff. The first step in navigating it is knowing your number.

How do you measure your potential Financial Cliff?

The Financial Cliff is the gap between your current annualized Microsoft run rate and your projected post-renewal run rate under the new model. Most organizations don’t know this number until late in the cycle. That’s a mistake. You cannot negotiate what you have not quantified. Here’s how to compute it:

1. Model your current annualized run rate.

Use your current license quantities and the pricing from your existing EA. This tells you what your renewal would look like if you could simply extend your current agreement for another cycle.

2. Model your projected renewal run rate.

Apply post–November 2025 pricing — and, where relevant, post–July 2026 pricing — to those same quantities. Remove past pricing concessions. Remove waterfall discount tiers. Apply any pricing protections you have, such as Not-to-Exceed clauses.

Pro move: If you’re already evaluating major add-ons at scale, or you can quantify Azure consumption tied to M365 workloads, layer that in. But start with the structural reset first.

3. That delta is your Financial Cliff.

Think of it as a ledger. On the left side is what you would pay if you could preserve today’s pricing. On the right side is what you’ll likely pay at renewal under the new structure. That gap is what you are negotiating.

How Not to Fall Off the Cliff

Historically, customers could rely on structural levers like scale, tenure, and platform alignment to soften renewal impact. In the post–volume discount era, those levers function differently. Microsoft now evaluates customers holistically. Volume still matters, but alignment, consumption trajectory, workload adoption, and strategic posture matter more.

There are new variables at play, but they can be turned into new leverage if applied correctly. In the posts that follow, we’ll unpack how to prepare — how Microsoft evaluates you as a customer, how M365 now anchors your leverage, how agreement strategy has become multidimensional, how Azure increasingly influences your EA, and how to position your organization for maximum leverage.

For now, compute your Financial Cliff. Have the conversation early. Nothing else matters if you don’t start with the number.